Here at KBDi, we’re always preaching about processes, profits, and the value of good business basics. We know our...

Business

Five good reasons to enter interior design awards

Entering interior design awards can offer numerous benefits for professionals in the field. KBDi Design Awards are now...

Building relationships with the industry’s best reps

Do you have a favourite product rep? Has a good rep saved your bacon with a perfect product solution? Here at KBDi, we...

Essential Webinar for Independent Contractors and Freelancers

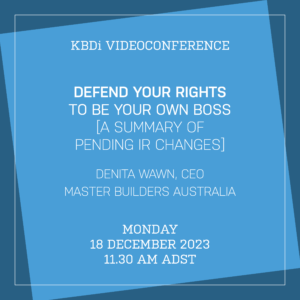

If you're an independent contractor, freelancer or self-employed individual, your right to choose to work for yourself...

Confused about Class 2 legislation in NSW?

There has been much discussion in the industry about recent changes to the NSW legislation related to Class 2...

100 days until Christmas; get ready to wrap up your year

With just over 100 days between now and Christmas, today is a great day to start preparing for your end-of-year...

Top ten tips for professional and effective emails

We're often harping on about clear and concise communication here at KBDi - mostly with respect to specifications and...